Staff Resources: Introduction to Truemed and Internal FAQ

Prior to launch, brief your team internally about Truemed. Once all key stakeholders have read through this guide, you are all set to begin your Truemed rollout.

An introduction to Truemed

What is Truemed?

Truemed partners with merchants and brands to enable qualified customers to use HSA/FSA funds on products and services that are used to treat, mitigate, or prevent a diagnosed medical condition.

Truemed partners with a network of practitioners who evaluate customers’ eligibility and issue Letters of Medical Necessity to qualifying customers.

Truemed is backed by best-in-class investors, including functional medicine pioneer Mark Hyman and founders from Thrive Market, Eight Sleep and Levels.

Check out our founders & hear more about our mission:

Justin on Invest Like the Best

Calley on Mark Hyman

Justin on Gary Brecka

How will Truemed increase my AOV, retention, and conversion rates?

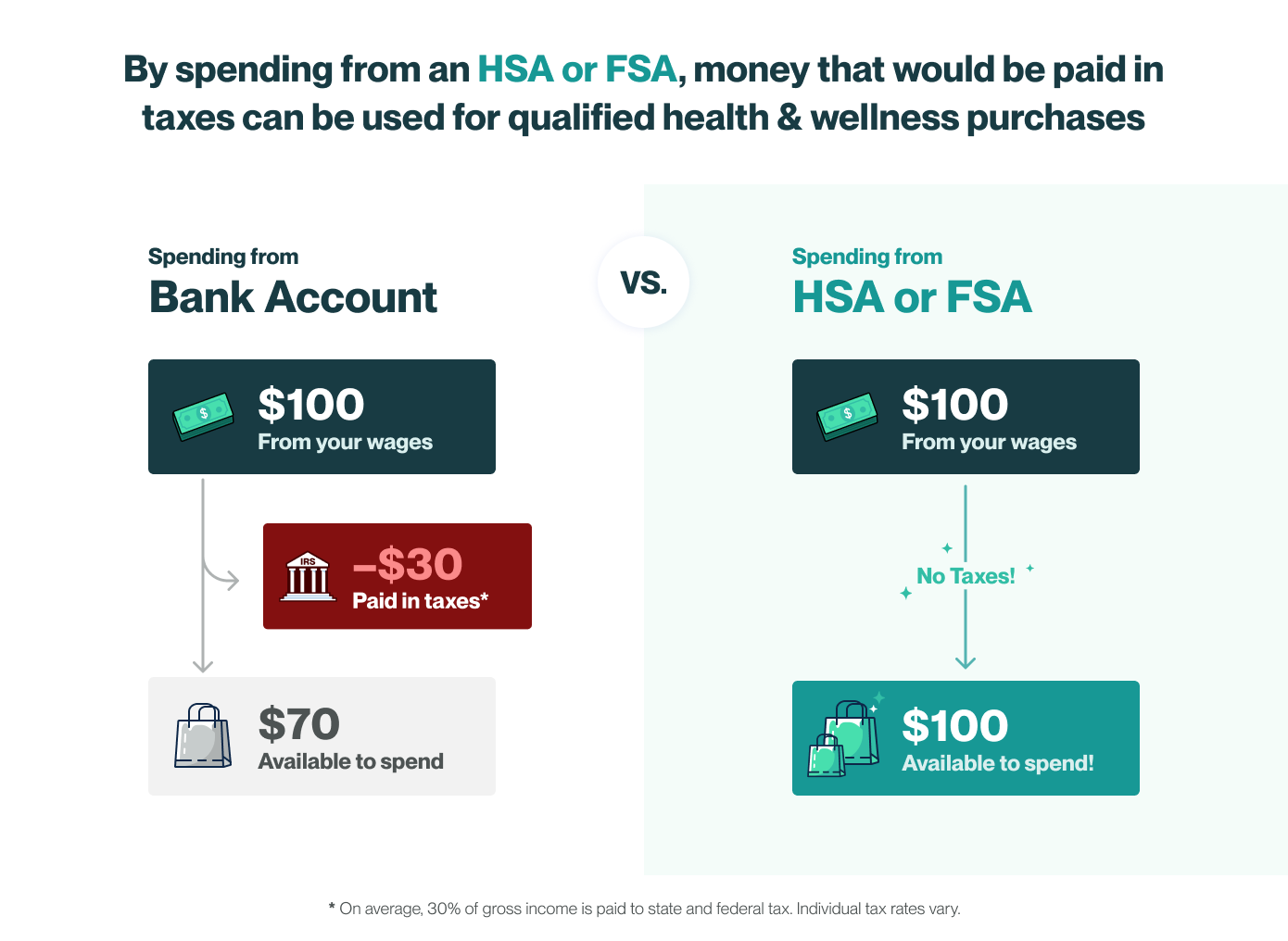

Because HSA/FSAs use pre-tax money, your customer is getting more purchasing power for their dollars. Since they are using pre-tax dollars, your customer is essentially saving a percentage equal to their tax rate.

Typically, customers using Truemed save an average of 30%.

These savings give customers more buying power, makes them less likely to churn, and helps to tip the scale for price sensitive spenders.

Case Studies:

Athletic Greens - 10% of aggregate sales via Truemed

Apothekary - 20% revenue lift after deploying Truemed

Viome - 3x increase in basket size

Momentous - 20% lift in AOV

Aletha Health - 13% of total orders

Higher DOSE - 15% of incremental sales

What does Truemed look like in action?

Shopify integration flow video walk through

Reimbursement flow video walk through

FAQs

These are common questions that we typically receive prior to a new partner launch. Review with your team, then head over to Marketing Resources to plan your Truemed debut.

Customer Support

Equip your support team to handle basic questions with our Questions Your Customers Might Ask guide.

For any questions that are not addressed here (including issues with HSA/FSA administrators or denied claims), please direct your customers to support@truemed.com and our team will be sure to assist.

Refunds

How do refunds work?

Customers will go through your normal refund process. Truemed will refund 50% of its fee.

One note: HSA/FSAs can sometimes have longer processing times than a normal bank. If a customer has not received a refund 15 business days after initiating, please direct the customer to reach out to their HSA/FSA administrator.

Finance and Accounting

How is Sales Tax handled for HSA/FSA payments?

Sales tax is still charged and eligible to be paid by FSAs and HSAs. More information here.

Stripe order reconciliation

Truemed pays out order totals, less our fees, on a rolling 2-day basis to the bank account you link via Stripe. Depending on order volume, the payouts are often batched. Your team can use the Truemed Dashboard at app.truemed.com to reconcile individual orders with their payout batches via the Download Report button on the Orders tab. To request additional accounts with access to your dashboard, reach out to merchants@truemed.com.

Truemed Checkout Process

Can clients get reimbursed if they use another payment method?

Yes. If customers want to use a non-HSA/FSA card and get reimbursed, they still need to select the Truemed payment option in order for Truemed to collect the information needed for our partner practitioners to issue a Letter of Medical Necessity. They can enter their non-HSA/FSA payment info at the end of the survey.

Does the email used at checkout have to match the email associated with their HSA/FSA account?

No, but the customers name should match between the order, their Truemed qualification survey, and their HSA/FSA account.

Truemed Evaluation Form

Should users answer for every condition that applies to them or only the condition that the product they wish to purchase is meant to help with?

Our survey prompts users to respond with all conditions they have been diagnosed with. In the case where they have not been diagnosed with anything but are trying to prevent a condition, we ask specifically what they are trying to prevent by making the purchase.

What is the Truemed Privacy Policy?

Please review our Privacy Policy.